|

|

|

|

|

NEW: Automatic Billing Option for Payment Schedules

|

|

|

|

We are pleased to announce that customers who choose a payment schedule will have an option to automatically bill a credit card or bank account (for echeck) on record for the remaining installment payments. This feature makes it easier for customers to ensure that their future installment payments are received on time without any additional actions, and helps organizations receive installment payments in a timely manner. Automatic billing is only available for customers who choose to pay with a credit card or by e-check. This feature is scheduled for release on September 30, 2020.

Whenever you create an event with a payment schedule option, the option to automate future payments is automatically displayed—no additional configuration is required. Every event or program with a payment schedule will present the automatic billing option to customers who choose to use the payment schedule.

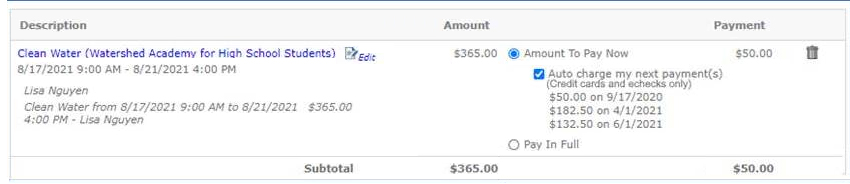

When customers register for an event or booking with a payment schedule, the Shopping Cart displays the option to pay a partial amount now or to pay in full. If the customer chooses to pay in full, checkout proceeds as usual and they will pay the full amount for the registration in this transaction.

|

|

|

|

If the Shopping Cart contains an item with a payment schedule, customers can choose partial or full payment. If the customer chooses to pay only the amount due today, options for automatic billing are displayed.

|

|

|

|

|

If a customer chooses to pay the partial amount due now, the Shopping Cart updates so they can choose whether the remaining payments will be automatically billed. If the customer does not authorize automatically charging the remaining payments, they must log on and manually enter all future payments, typically in response to your custom billing reminders.

|

|

|

Customers who choose automatic billing can update their payment method in the My Account section of the site.Organization staff can view information about recurring payments in Financial Accounts.

To support automatic billing, the way that payments schedules work has changed. Customers can no longer choose a custom amount for the initial payment or for future payments regardless of whether or not they choose automatic billing.

Contact support@doubleknot.com if you have any questions.

|

|

|

|

|

|

|

|

VIDEO: Using the New Email and Newsletter Design Tools

|

|

|

|

Doubleknot’s new built-in Newsletter and Email Composer empowers your team to create beautifully formatted and mobile-friendly emails and newsletters that are sent through Communications Center to the recipient list of your choice.

The complete how-to webinar is available here. A PDF of the presentation is also available on the page.

|

|

|

|

|

|

|

|

|

|

Automatic Credit Card Updates Now Available on Togetherpay

|

|

|

|

Organizations that use Togetherpay payment processing can now take advantage of update service for credit cards used in recurring payments. If a stored credit card number and/or expiration date has changed, the credit card company will automatically update the stored information, and the next billing cycle will use the updated card information. The transaction fee for each automatic update of stored credit card information is the same flat-rate charge as any online transaction.

|

|

|

|

Items that support recurring payments and card update services include:

|

|

|

|

When a stored credit card is no longer used for recurring transactions, the card is no longer stored for use by Doubleknot and will no longer be automatically updated

|

|

|

|

|

|

|

|

REMINDER: Vantiv and Authorize.net Will Not Be Supported After November 30. 2020

|

|

|

|

On November 30, 2020, Doubleknot will end support for the Vantiv and Authorize.net payment processing platforms. To provide better service, we support Togetherpay, powered by Stripe, which offers a range of benefits that include:

|

|

|

-

Better protection of credit card data, especially for recurring donations and automatic membership renewals

-

Built-in credit card updater services so stored expiration dates and account numbers are always up to date

-

Industry-leading AI-based fraud protection

-

Automatic reconciliation of deposits

|

|

Our customer support team has been reaching out directly to organizations who will be impacted by this change. For more information or to arrange a switch, contact Kevin Kurk, Solutions Manager, at 716.691.2800 x315 or KKurk@doubleknot.com.

|

|

|

|

|

|

|

|

| |

| |